A budget is the backbone of any successful business. It helps keep you on track with your expenses and goals and allows you to plan for the future.

When it comes to creating a monthly budget, there are a lot of templates available. But if you want to take it further and make it more user-friendly, you must create your own.

This free template will allow you to build your budget, which is perfect for newbies and experts.

Budgeting is a process of planning and tracking money and expenses so that you can keep track of what you have, how much you have left to spend, and what you have left to pay off. With a simple Excel template, you can create a monthly budget that gives you a better idea of where you stand financially at any point in time. This will help you stay on track with paying off debts, buying necessities, and saving money for a rainy day.

Excel budget templates

Several free and paid templates are available, but if you want to create something truly user-friendly, you’ll need to make one from scratch.

It doesn’t matter how much money you’ve saved up for a month because it’s always better to put it into savings than spend it. So here’s what you need to do:

Step 1: Get started

- Create a blank worksheet in Excel

- Label columns for each section of your budget (Monthly Income, Monthly Expenses, Monthly Savings)

- Write down your income and expenses

- Add a column for each month and write down the amount you want to save in that particular month.

- Add a column for the total amount of money saved for the month

- Make sure the last row of your worksheet is the total amount of money for the entire year

Step 2: Calculate totals

- Subtract the monthly savings amount from the monthly expenses. If the result is positive, then you have enough money to save. If the impact is negative, you should consider lowering your costs.

- Repeat steps 4-7 until you reach a positive amount.

- Divide the total amount by 12 to find your average monthly savings

- Multiply your average monthly savings by 12 to find the total amount of money you should save this year

- Add it all up

- Subtract the total amount of money you’ve spent from the total amount you’ve saved. This is the amount you need to put aside for the next month.

- Repeat steps 10-12 until you reach a positive amount.

- Divide your total money by 12 to find your average monthly saving.

- Multiply your average monthly saving by 12 to find the total money you should save this year.

Create a monthly budget in Excel

A good monthly budget template should contain two things.

- It should include key figures such as income and expenses.

- It should provide a nice visual representation of the data.

You can use a simple chart like the one below.

The idea is to create a budget that is both visually appealing and easy to understand.

The budget is split into two parts, the first being the projected revenue and the second being the projected expenses. The budget’s revenue side is represented by the colored bars; the left side shows the projected revenue in red, and the right side shows the projected revenue in blue. The actual payment for each month is shown in green. Expenses are represented by the orange bars, with the left-hand side showing the projected costs in orange and the right-hand side showing the projected expenditures in yellow. The actual prices for each month are shown in purple.

Create a daily budget in Excel.

The process of creating a budget is fairly straightforward. You take each item on your list and create a column for its related expense.

Before you start, ensure you have a good handle on your expenses. If you’re unsure, ask yourself how much money you have left to spend at the end of the month.

To create a daily budget, start with the monthly budget and divide it by the number of days a month. For example, if you spend $1,000 monthly, you divide it by 30.

Then, divide that number by $50 to get the daily budget.

Monthly budget templates for Excel

The Monthly Budget Template Excel Template inspires this month’s budget template.

The key to making a good monthly budget template is to make it easy to follow. If you’ve been tracking your spending for a while, you know how hard it can be to stay organized.

But it becomes much easier to stay on track when you use an Excel template.

To create the template, you’ll need an Excel sheet containing a list of your monthly expenses. Each column should be labeled with the name of the cost.

For example, you could have one column labeled “car”, one labeled “housing”, one labeled “food”, etc.

Then you’ll need to add the total amount spent on each category.

Finally, labeling each row with the month and year would be best.

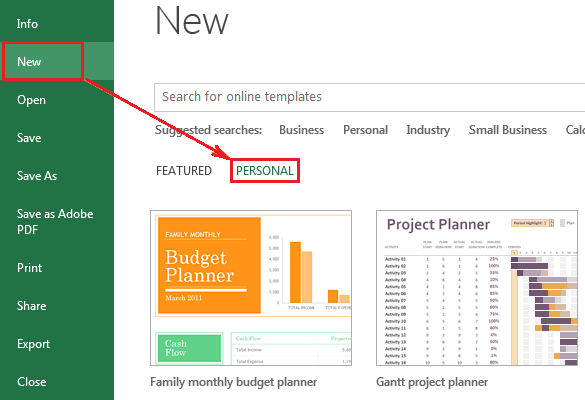

The next step is to find a monthly budget template on the internet.

Plenty of free templates are available and usually require a little tweaking. But if you want to take it further, you can use a pad template to make it look like a professional document.

Frequently asked questions about the budget templates in Excel

Q: Can I use a Microsoft Excel template for budgeting my finances?

A: Yes, but there are two versions that you should download. One version is a simple budget template, and the other is a simple one with additional features.

Q: Which version of the budget template should I download?

A: You need the Budget Template with Additional Features. There is no reason to pay for a budget template without additional features.

Q: How do I use the Budget Template with Additional Features?

A: To use the Budget Template with Additional Features, enter the numbers into the spreadsheet first. Once you have entered your numbers, you can create your budget template from scratch.

Top myths about the budget templates in Excel

- All accountants do not use a budget template in Excel.

- An Excel budget template has to be created in advance before using it.

- There are many reasons for creating a budget template.

Conclusion

A budget template in Excel is something that every new entrepreneur needs. It should be something that everyone has to have on hand.

I created this template to help me track my expenses and pay off debts quickly and easily. I made it super simple to use, and it’s already paid for itself many times.

You don’t need to spend a fortune on software. I use this template in Microsoft Excel to make it easy to track my spending.

It also comes with many pre-made categories that you can use to keep track of your monthly expenses.